By Prabin Soren | Updated: July 2025

Hey there, fellow freelancer or solopreneur!

Let’s be honest. When you decided to work for yourself, you probably dreamed about creating amazing things, helping clients, and being your own boss. You probably didn’t dream about spreadsheets, receipts, and confusing money terms, right?

But here’s the thing: understanding two simple ideas – Income vs Expense – is like having a superpower for your business. It’s the secret sauce to knowing if you’re truly making money, or if you’re just busy.

I’m Prabin Soren, and I’ve been working with numbers and money since 2019. That’s 6 years of seeing how businesses, big and small, handle their cash. I regularly share my thoughts and tips on LinkedIn because I truly believe that understanding your money doesn’t have to be hard. In this blog, I’ll break down income and expenses in the simplest way possible, share my own journey, and show you how Octotally can make it all stress-free.

Ready to unlock your money superpower? Let’s dive in!

What Do You Mean by Income vs Expense?

Let’s start with the very basics. Think of your business like a bucket.

Income: Money Coming IN

Income is simply all the money that flows into your business bucket. It’s what you earn from selling your services, products, or anything else your business does.

Why it matters: This is the fuel for your business. Without income, there’s no business!

Simple Examples of Income for a Freelancer/Solopreneur:

- Payment for a project: You designed a logo for a client and they paid you ₹15,000. That’s income!

- Selling a digital product: You created an e-book and sold 10 copies at $20 each. That $200 is income.

- Consulting fees: You spent an hour giving advice to a startup and charged them ₹5,000. That’s income.

- Affiliate commissions: You recommended a tool, and when someone bought it through your link, you got a small cut. That’s also income.

Expense: Money Going OUT

Expense is all the money that flows out of your business bucket. It’s the cost of doing business – the money you spend to keep your operations running and to earn that income.

Why it matters: Expenses reduce your income. Knowing your expenses helps you understand how much money you actually get to keep.

Simple Examples of Expenses for a Freelancer/Solopreneur:

- Software subscriptions: You pay $15 a month for a graphic design tool. That’s an expense.

- Website hosting: Your website costs ₹500 a month to keep online. Expense!

- Internet bill: A portion of your home internet if you work from home.

- Marketing costs: You spent ₹2,000 on Facebook ads to promote your services. Expense.

- Office supplies: Pens, notebooks, printer ink – all expenses.

- Travel for client meetings: The cost of your train ticket or fuel.

Why It’s Important for Freelancers and Solopreneurs

Okay, so you know what income and expenses are. But why is it so important for you specifically, as someone running your own show?

Think about it: when you work for a company, they handle all the complex money stuff. You just get a paycheck. But as a freelancer or solopreneur, you are the company. If you don’t keep track, you’re flying blind!

Here’s why it’s crucial:

- Know Your True Profit: You might earn a lot of income, but if your expenses are even higher, you’re actually losing money! Tracking both helps you see your net profit (Income – Expenses = Profit). This is your real take-home pay from the business.

- Example: You earned ₹50,000 this month (Income). But you spent ₹20,000 on software, marketing, and office supplies (Expenses). Your real profit is ₹30,000. If you didn’t track expenses, you might think you have ₹50,000 to spend!

- Make Smart Decisions: Knowing where your money goes helps you make better choices. Should you invest in a new tool? Can you afford that marketing campaign? Should you raise your prices? The answers come from your income and expense data.

- Easier Tax Time (Huge Relief!): This is a big one. Tax authorities want to know your income and your expenses. Tracking expenses allows you to claim deductions, which means you pay less tax! If you don’t track them, you might end up paying more than you need to.

- Spot Problems Early: If your expenses are suddenly much higher than your income, you’ll see it quickly. This lets you fix the problem before it gets too big.

- Plan for the Future: Want to save for a new laptop, expand your services, or take a vacation? Understanding your income and expenses helps you plan and save effectively.

Benefits to Track Income and Expense

Let’s put it simply. When you track your income and expenses, you get:

- Clarity: You know exactly how much money is coming in and going out. No more guessing!

- Control: You feel in charge of your money, not like your money is controlling you.

- Confidence: You can confidently talk about your business’s financial health.

- Peace of Mind: Less stress about money, especially when tax season looms.

- Growth Potential: You can make smarter choices to grow your business because you have real numbers to guide you.

My Experience Using the Tool

As someone who has worked with money and numbers since 2019, I’ve seen countless tools. Some were super complicated, built for huge companies, and others were just basic spreadsheets that required a lot of manual work. My own personal challenge was always finding something truly simple but still good enough for my own small side projects and for the small businesses I advise.

I have tracked Income and expenses, look what benefits I received. I decided to use Octotally for one of my own small consulting jobs, just to see how it felt in a real-world setting. I used these tools for 10 days – here’s my honest review.

From the very first day, putting in my money details felt so natural. I didn’t need to read any instructions or watch tutorials. Logging income from a client (like when I got paid for writing an article), noting down my monthly internet bill, and even recording a small purchase for my business (like new software) was fast and smooth. The feature that changes currencies was a huge help, as I often work with both Indian Rupees (INR) and US Dollars (USD). No more manual calculations for me!

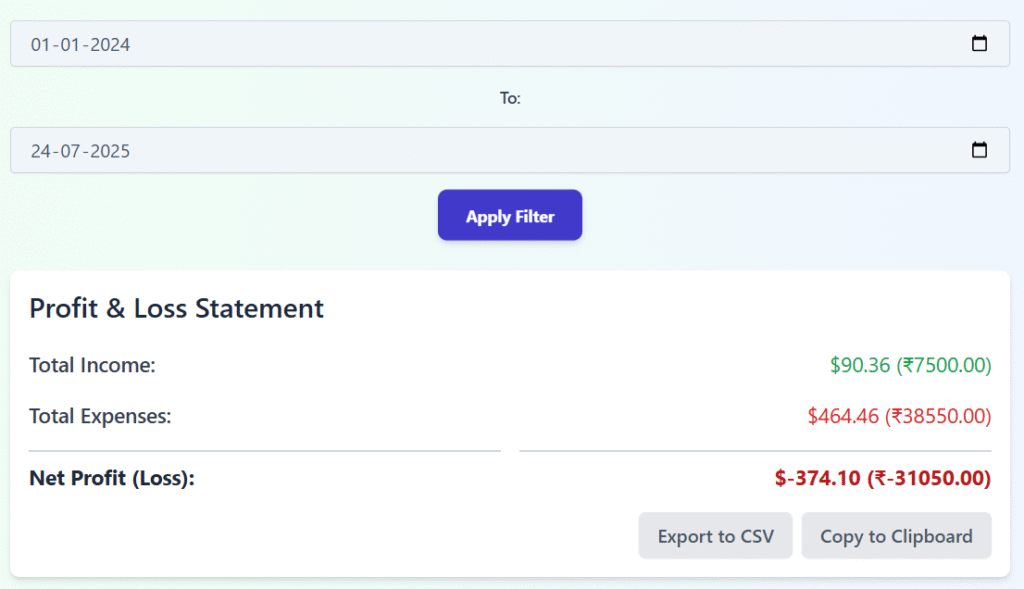

The biggest surprise, and honestly, the best part, came when I went to the “Reports” tab. Right away, I saw a clear Profit & Loss statement showing exactly what I earned and what I spent. The Balance Sheet gave me a quick, easy-to-understand look at my business’s financial health – what I owned versus what I owed. And the Cash Flow statement? That helped me truly understand how money was actually moving in and out of my business bank account, not just what looked good on paper.

How do these tools help me? How will they help you? For me, Octotally saves me hours of manual work every week. It gives me clear information right away, so I can focus on my main job – helping my clients – instead of getting stuck in numbers. For you, it means you can take control of your money without needing to hire an accountant right away, or spending a lot of money on expensive software. It empowers you to truly understand your business’s money story yourself.

Case Study: What Happened in My Life After Tracking Income and Expense

Before Octotally, the money side of my personal side business was, well, a bit of a mess. I had receipts scattered everywhere (yes, even I do that sometimes!) and a basic spreadsheet I tried (and often failed) to update once a month. This meant a lot of guessing and worrying, especially when it came to figuring out how much tax I might owe or if a new client project was really making me money after all the costs.

For example, I took on a new marketing project that seemed like a really good deal. I carefully put all the income I received and all the related costs (like advertising fees and tools) into Octotally as they happened. After just one week, I decided to look at the Profit & Loss report. To my surprise, a certain software subscription I had bought for the project, combined with some unexpected travel costs, meant the project wasn’t making as much profit as I first thought.

- Before Octotally: I would have only found this out at the end of the month, or even worse, when tax time came around. By then, it would have been too late to do anything about it. I would have just accepted the lower profit.

- After Octotally: I saw the problem right away, while the project was still ongoing! This quick information helped me make immediate changes. I could adjust my pricing for future projects, look for cheaper software, and even talk to the client about better terms for additional work.

This wasn’t just about saving money; it was about feeling in charge and sure of myself. I could make smart choices quickly, instead of being surprised by problems later. This clear view of my finances made me much less stressed and allowed me to focus on doing great work for my clients, knowing my financial house was in order.

How is it Beneficial for Me?

Octotally has become a must-have tool for me, and here’s why it’s so helpful for me, and how these same benefits will help you:

- Instant Clear View: I don’t have to wait until the end of the month to know how my money is doing. Octotally gives me real-time updates, so I can see trends (like if my income is going up or down), catch problems early (like unexpected high expenses), and grab opportunities right away (like seeing if I have enough cash for a new investment).

- Saves Time: My schedule is busy, so every minute counts. Octotally’s easy way of putting in data and its automatic reports save me hours each week that I used to spend on manual math and updating spreadsheets. Imagine what you could do with those extra hours!

- Better Decisions: With clear Profit & Loss, Balance Sheet, and Cash Flow statements ready when I need them, I can make smart business choices based on real numbers, not just guesses. This means you can set better prices, make smarter investments, and find better ways to manage your costs.

- Less Tax Season Stress: Having all my income and expenses neatly grouped and easy to save, getting ready for taxes will be much simpler. No more rushing around for old receipts!

- Peace of Mind: Knowing that my money data is private and saved only on my device gives me a huge sense of calm. I control my data, and that’s a powerful feeling that I want you to experience too.

How Octotally (Your Finance Manager) Helps Track Income and Expense and How Easy It Is to Track

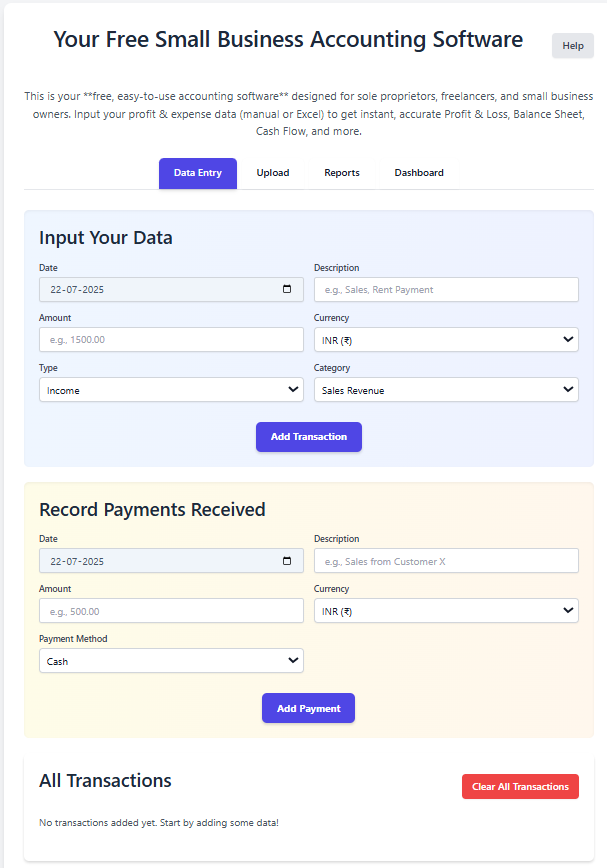

Octotally is built to make tracking income and expenses incredibly simple. Here’s how it works and why it’s so easy:

- Clear “Data Entry” Tab: When you open Octotally, you’ll land on the “Data Entry” tab. This is your main hub. It’s clean, uncluttered, and designed for quick input.

- Intuitive Fields:

- Date: Just pick the date.

- Description: Type in what happened. “Sold 5 handmade candles,” “Paid for new website font.”

- Amount: Enter the number.

- Currency: Choose INR or USD. Octotally handles the conversion for reports!

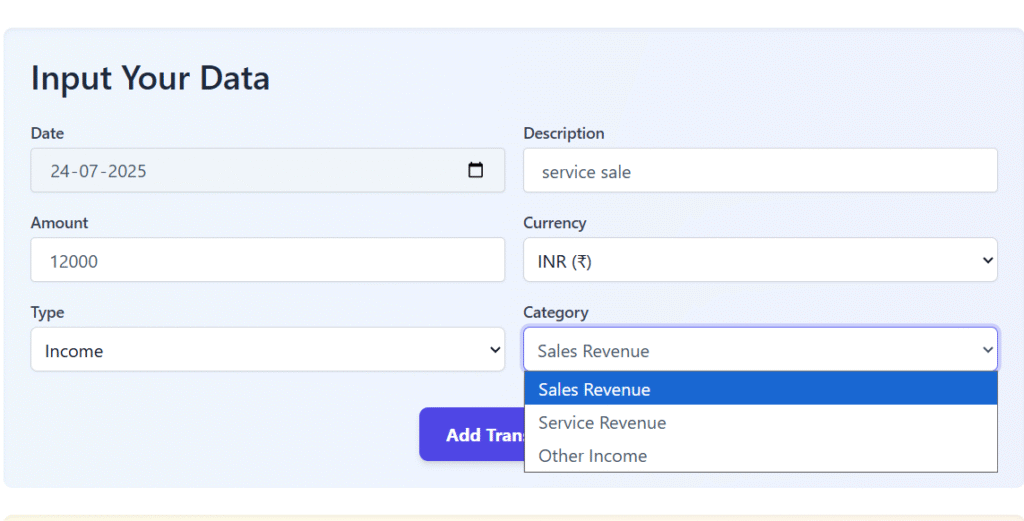

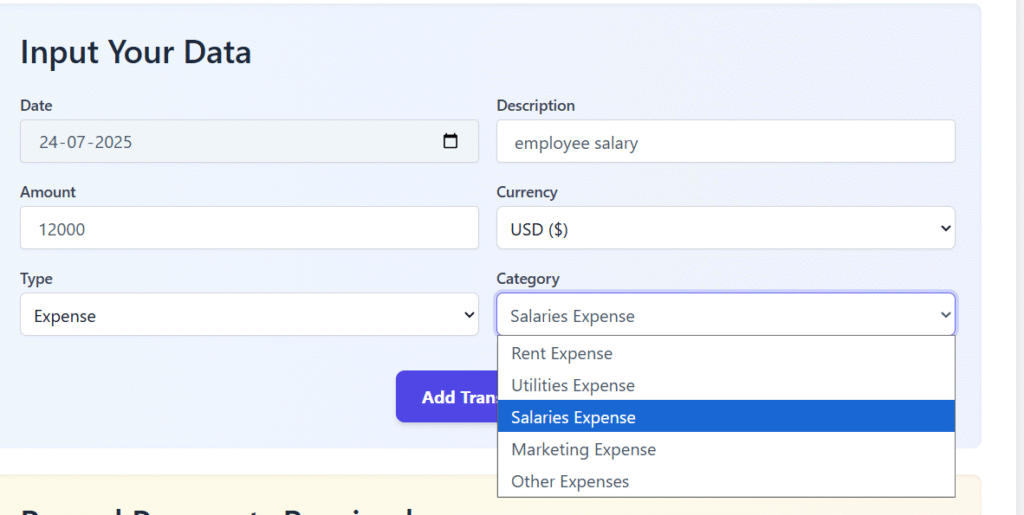

- Type: This is where you choose “Income” or “Expense.” It’s a simple dropdown.

- Category: Once you pick “Income” or “Expense,” the categories automatically change to relevant options like “Sales Revenue” or “Rent Expense.” No need to remember complex codes!

- Example: You finished a small writing gig and received ₹7,000.

- You’d select “Income” for Type.

- Then, for Category, you’d pick “Service Revenue.”

- Enter the date, description (“Writing gig for BlogCo”), and amount. Done!

- Example: You paid your monthly internet bill for ₹800.

- You’d select “Expense” for Type.

- Then, for Category, you’d pick “Utilities Expense.”

- Enter the date, description (“Internet bill – July”), and amount. Easy!

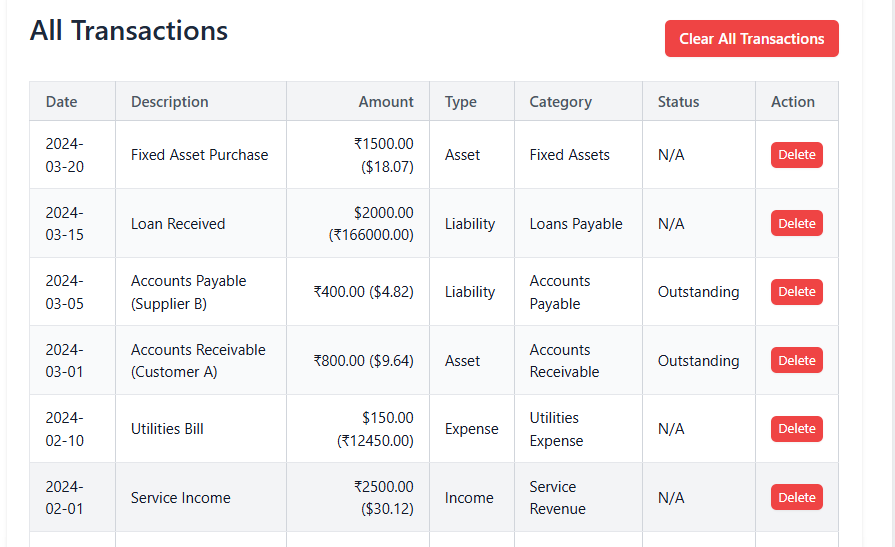

- Instant “All Transactions” List: As soon as you hit “Add Transaction,” your entry appears in the “All Transactions” list below. It’s a live record, so you can always see what you’ve logged.

- Quick Reports for Overview: Once you have a few entries, hop over to the “Reports” tab and select “Profit & Loss.” Instantly, you’ll see your total income, total expenses, and your net profit. It’s that fast!

This simple flow means you don’t need to be an accountant. You just need to know if money came in or went out, and Octotally does the rest of the heavy lifting for you.

Ready to Get Started?

Your financial journey begins with a single step. Octotally is here to make that step, and every step after, as easy and stress-free as possible. Why wait? Start recording your transactions today and get the clear money picture your small business needs.

Visit www.octotally.com now and begin your journey to stress-free small business accounting!

About the Author

Who am I, and why do I write this?

Hi, I’m Prabin Soren, and I absolutely love helping people understand their money. My special focus is on small business owners and freelancers. With 6 years of experience in accounting and finance, I’ve personally seen how much many business owners struggle with their books. My journey in finance started in 2019, and since then, I’ve focused on making tricky money ideas simple to understand for everyone.

Why listen to me?

My experience isn’t just from textbooks. I’ve worked with many different businesses, helping them figure out their money situations and get organized. I also have my own small projects, where I actually use the very same ideas and tools I suggest to you. So, I know the real problems you face because I go through them too! I often share my thoughts and blog posts on my LinkedIn profile to help even more people.

You can contact me directly here: [octotally@gmail.com]