By Prabin Soren | Updated: July 2025

Hey there, fellow business owner!

Ever feel like your money just… disappears? Or maybe you’re super busy making sales, but you’re not quite sure how much you’re really taking home at the end of the day? It’s a common feeling, especially when you’re running your own show. You’ve got so much on your plate, and sometimes, keeping track of every single money movement feels like a chore you can put off until later.

But what if I told you that spending just a few minutes each day on your “daily transactions” can unlock huge clarity and peace of mind for your business? It’s true!

I’m Prabin Soren, and I’ve been working with money and numbers since 2019, so I have 6 years of experience in accounting and finance. I regularly share my thoughts and tips on LinkedIn because I truly believe that understanding your money doesn’t have to be hard. In this blog, I’ll explain what daily transactions are, why they’re your secret weapon, and how Octotally – your finance manager makes tracking them super easy.

Ready to take control of your daily money flow? Let’s get started!

What is a Daily Transaction?

Let’s keep it simple. A daily transaction is any money event that happens in your business on a given day. Think of it as a financial diary entry. It’s not just about big sales or major bills; it’s about every time money moves in or out, or when something changes value in your business.

Examples of Daily Transactions:

- You sell a handmade piece of jewelry for ₹1,200. That’s a daily transaction (income!).

- You buy new printer ink for $15. That’s a daily transaction (expense!).

- A client pays you ₹10,000 for a project you finished last week. Daily transaction (income!).

- You pay your monthly website hosting bill for $20. Daily transaction (expense!).

- You transfer ₹5,000 from your business bank account to your business cash box. That’s also a daily transaction (moving money between assets).

See? It’s just about recording what happens with your money, day by day.

What Should You Include in a Daily Transaction Record?

To make your daily transactions truly helpful, each record should include a few key pieces of information. Think of it like telling a complete story about that money event:

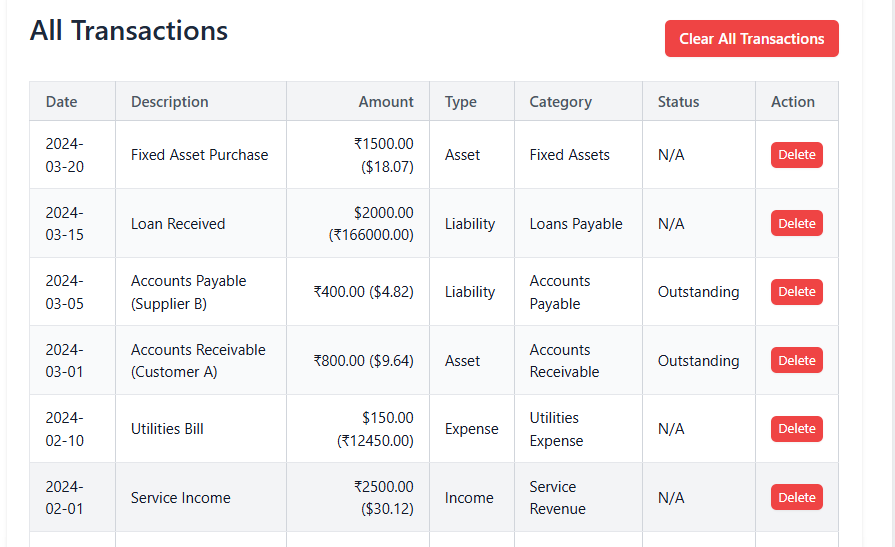

- Date: When did it happen? (e.g., July 28, 2025)

- Description: What was it for? Be clear! (e.g., “Sale of custom t-shirt,” “Paid electricity bill,” “Bought new design software”)

- Amount: How much money? (e.g., ₹1200, $15)

- Currency: Is it in Indian Rupees (INR) or US Dollars (USD)? Octotally lets you pick!

- Type: Is this money Income (coming in), Expense (going out), an Asset (something you own), a Liability (something you owe), or Equity (your ownership stake)?

- Category: This is super important for reports! What kind of income or expense was it? (e.g., “Sales Revenue,” “Utilities Expense,” “Marketing Expense”). Octotally helps you choose from a list.

- Related Party (if needed): Who was involved? (e.g., “Customer A,” “Supplier B”). This is especially useful for tracking who owes you or who you owe.

- Is Paid (if needed): For money you’re owed or that you owe, was it paid or is it still outstanding?

Including these details for every money event helps you build a complete and accurate picture of your business’s finances.

Why Daily Transactions are Important (and Why You Should Record Them)

You might be thinking, “Do I really need to track every single thing?” And my answer is a resounding YES! Here’s why recording your daily transactions is so important and why you should make it a habit:

- Know Your Real Money Situation: Without daily tracking, you’re guessing. You might feel busy, but are you actually making a profit? Daily records tell you the truth.

- Spot Problems Fast: If you’re spending too much on something, or if a certain income stream dries up, you’ll see it right away. This lets you fix things before they become big problems.

- Easier Tax Time, Less Stress: This is a huge benefit! When all your income and expenses are neatly recorded, preparing for taxes becomes a breeze. You’ll have all the numbers ready, which can save you time, money (through deductions!), and a lot of headaches.

- Make Smarter Decisions: Want to buy new equipment? Thinking about hiring help? Daily records give you the clear financial picture you need to make smart, confident choices for your business’s future.

- Proof for Banks or Investors: If you ever need a loan or want to bring in investors, clear, consistent daily records show them you’re serious and organized.

How Daily Transaction Helps Your Business

Think of your daily transactions as the heartbeat of your business. Each beat (each transaction) tells you something vital about your business’s health.

- It’s Your Early Warning System: Imagine you suddenly start spending a lot more on software subscriptions. If you’re tracking daily, you’ll notice this jump quickly. You can then ask: “Is this new software really worth it? Can I find a cheaper option?” Without daily tracking, you might only see this at the end of the month, or even later, when it’s harder to make changes.

- It Shows You Where Your Money Comes From and Goes: Are your sales up? Are your marketing costs too high? Daily tracking lets you see patterns. For example, if you see a lot of “Service Revenue” transactions, you know that’s a strong area. If “Other Expenses” are growing, you can dig deeper to find out why.

- It Builds a Strong Foundation: Just like building a house, you need a strong foundation. Daily transaction records are that foundation for your business’s financial health. They allow you to build accurate reports (like Profit & Loss) that truly reflect your business’s performance.

By paying attention to these small, daily details, you gain a powerful understanding of your business’s overall financial flow. This isn’t just about numbers; it’s about gaining control and confidence.

My Experience Using the Tool

As someone who has worked with money and numbers since 2019, I’ve seen countless tools. Some were super complicated, built for huge companies, and others were just basic spreadsheets that required a lot of manual work. My own personal challenge was always finding something truly simple but still good enough for my own small side projects and for the small businesses I advise.

I have tracked Income and expenses, look what benefits I received. I decided to use Octotally for one of my own small consulting jobs, just to see how it felt in a real-world setting. I used these tools for 10 days – here’s my honest review.

From the very first day, putting in my money details felt so natural. I didn’t need to read any instructions or watch tutorials. Logging income from a client (like when I got paid for writing an article), noting down my monthly internet bill, and even recording a small purchase for my business (like new software) was fast and smooth. The feature that changes currencies was a huge help, as I often work with both Indian Rupees (INR) and US Dollars (USD). No more manual calculations for me!

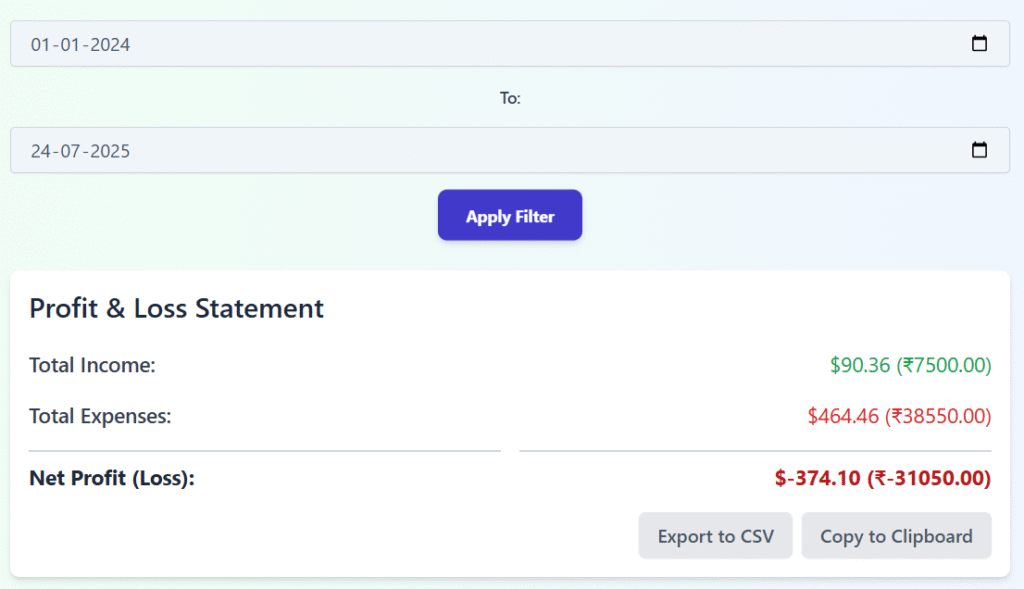

The biggest surprise, and honestly, the best part, came when I went to the “Reports” tab. Right away, I saw a clear Profit & Loss statement showing exactly what I earned and what I spent. The Balance Sheet gave me a quick, easy-to-understand look at my business’s financial health – what I owned versus what I owed. And the Cash Flow statement? That helped me truly understand how money was actually moving in and out of my business bank account, not just what looked good on paper.

How do these tools help me? How will they help you? For me, Octotally saves me hours of manual work every week. It gives me clear information right away, so I can focus on my main job – helping my clients – instead of getting stuck in numbers. For you, it means you can take control of your money without needing to hire an accountant right away, or spending a lot of money on expensive software. It empowers you to truly understand your business’s money story yourself.

Case Study: What Happened in My Life After Tracking Daily Transactions

Before Octotally, the money side of my personal side business was, well, a bit of a mess. I had receipts scattered everywhere (yes, even I do that sometimes!) and a basic spreadsheet I tried (and often failed) to update once a month. This meant a lot of guessing and worrying, especially when it came to figuring out how much tax I might owe or if a new client project was really making me money after all the costs.

For example, I took on a new marketing project that seemed like a really good deal. I carefully put all the income I received and all the related costs (like advertising fees and tools) into Octotally as they happened, day by day. After just one week, I decided to look at the Profit & Loss report. To my surprise, a certain software subscription I had bought for the project, combined with some unexpected travel costs, meant the project wasn’t making as much profit as I first thought.

- Before Octotally: I would have only found this out at the end of the month, or even worse, when tax time came around. By then, it would have been too late to do anything about it. I would have just accepted the lower profit.

- After Octotally: I saw the problem right away, while the project was still ongoing! This quick information helped me make immediate changes. I could adjust my pricing for future projects, look for cheaper software, and even talk to the client about better terms for additional work.

This wasn’t just about saving money; it was about feeling in charge and sure of myself. I could make smart choices quickly, instead of being surprised by problems later. This clear view of my finances made me much less stressed and allowed me to focus on doing great work for my clients, knowing my financial house was in order.

How is it Beneficial for Me?

Octotally has become a must-have tool for me, and here’s why it’s so helpful for me, and how these same benefits will help you:

- Instant Clear View: I don’t have to wait until the end of the month to know how my money is doing. Octotally gives me real-time updates, so I can see trends (like if my income is going up or down), catch problems early (like unexpected high expenses), and grab opportunities right away (like seeing if I have enough cash for a new investment).

- Saves Time: My schedule is busy, so every minute counts. Octotally’s easy way of putting in data and its automatic reports save me hours each week that I used to spend on manual math and updating spreadsheets. Imagine what you could do with those extra hours!

- Better Decisions: With clear Profit & Loss, Balance Sheet, and Cash Flow statements ready when I need them, I can make smart business choices based on real numbers, not just guesses. This means you can set better prices, make smarter investments, and find better ways to manage your costs.

- Less Tax Season Stress: Having all my income and expenses neatly grouped and easy to save, getting ready for taxes will be much simpler. No more rushing around for old receipts!

- Peace of Mind: Knowing that my money data is private and saved only on my device gives me a huge sense of calm. I control my data, and that’s a powerful feeling that I want you to experience too.

How Octotally (Your Finance Manager) Helps Track Daily Transactions and How Easy It Is to Track

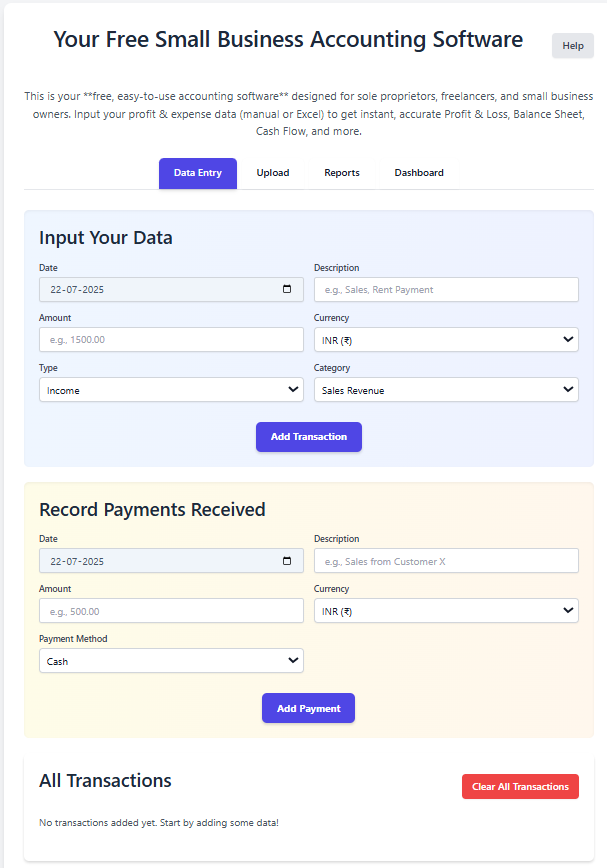

Octotally is built to make tracking income and expenses incredibly simple. Here’s how it works and why it’s so easy:

- Clear “Data Entry” Tab: When you open Octotally, you’ll land on the “Data Entry” tab. This is your main hub. It’s clean, uncluttered, and designed for quick input.

Intuitive Fields:

- Date: Just pick the date.

- Description: Type in what happened. “Sold 5 handmade candles,” “Paid for new website font.”

- Amount: Enter the number.

- Currency: Choose INR or USD. Octotally handles the conversion for reports!

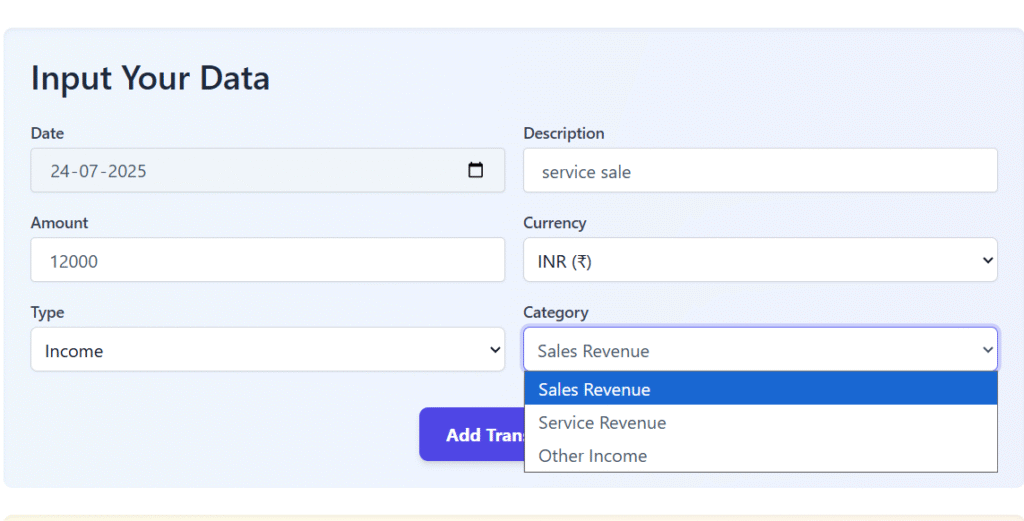

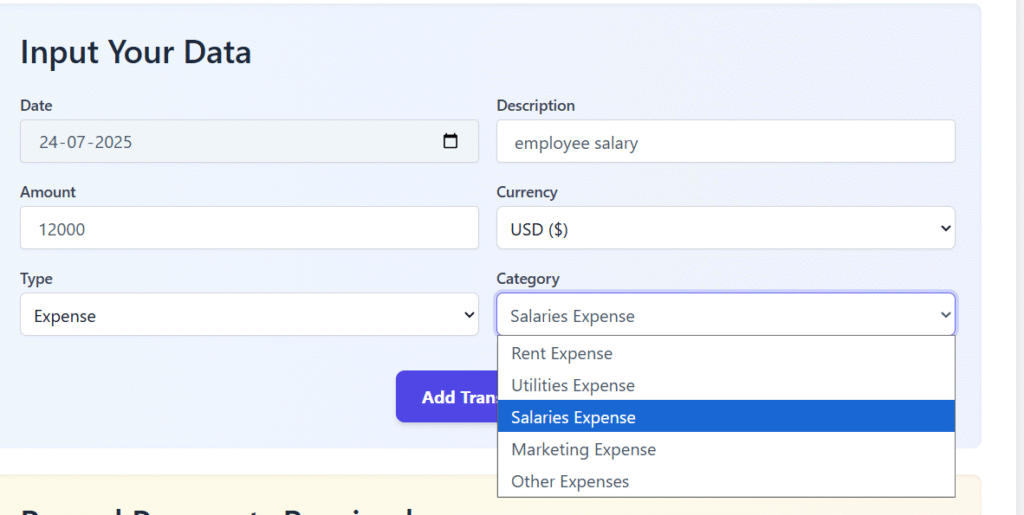

- Type: This is where you choose “Income” or “Expense.” It’s a simple dropdown.

- Category: Once you pick “Income” or “Expense,” the categories automatically change to relevant options like “Sales Revenue” or “Rent Expense.” No need to remember complex codes!

- Example: You finished a small writing gig and received ₹7,000.

- You’d select “Income” for Type.

- Then, for Category, you’d pick “Service Revenue.”

- Enter the date, description (“Writing gig for BlogCo”), and amount. Done!

- Example: You paid your monthly internet bill for ₹800.

- You’d select “Expense” for Type.

- Then, for Category, you’d pick “Utilities Expense.”

- Enter the date, description (“Internet bill – July”), and amount. Easy!

- Instant “All Transactions” List: As soon as you hit “Add Transaction,” your entry appears in the “All Transactions” list below. It’s a live record, so you can always see what you’ve logged.

- Quick Reports for Overview: Once you have a few entries, hop over to the “Reports” tab and select “Profit & Loss.” Instantly, you’ll see your total income, total expenses, and your net profit. It’s that fast!

This simple flow means you don’t need to be an accountant. You just need to know if money came in or went out, and Octotally does the rest of the heavy lifting for you.

Ready to Get Started?

Your financial journey begins with a single step. Octotally is here to make that step, and every step after, as easy and stress-free as possible. Why wait? Start recording your transactions today and get the clear money picture your small business needs.

Visit https://octotally.com/ now and begin your journey to stress-free small business accounting!

About the Author

Who am I, and why do I write this?

Hi, I’m Prabin Soren, and I absolutely love helping people understand their money. My special focus is on small business owners and freelancers. With 6 years of experience in accounting and finance, I’ve personally seen how much many business owners struggle with their books. My journey in finance started in 2019, and since then, I’ve focused on making tricky money ideas simple to understand for everyone.

Why listen to me?

My experience isn’t just from textbooks. I’ve worked with many different businesses, helping them figure out their money situations and get organized. I also have my own small projects, where I actually use the very same ideas and tools I suggest to you. So, I know the real problems you face because I go through them too! I often share my thoughts and blog posts on my LinkedIn profile (replace with actual LinkedIn URL) to help even more people.

You can contact me directly here: [Octotally@gmail.com].